Choosing the right bank account for your small business can make a world of difference in managing your finances effectively. With so many options available, it’s easy to feel overwhelmed. However, the right account can save you time, reduce fees, and streamline your operations.

As a small business owner in the UK, you need to consider factors like transaction limits, online banking features, and customer support. Whether you’re just starting out or looking to switch banks, understanding what to look for can help you make an informed decision. Let’s delve into what makes a bank account truly beneficial for your small business.

Essential Features of a Bank Account for Small Business

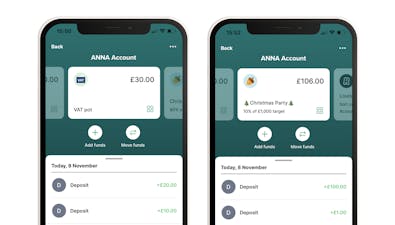

A bank account for small business models should ideally be easy to use, as this can make daily tasks like transferring money, paying bills, and checking balances simple and fast. Look for banks that offer intuitive online platforms. A user-friendly interface lets you complete transactions easily. Mobile apps can also be helpful. They enable you to manage finances on the go. The banking app should be secure and reliable, ensuring your data remains protected.

Fee Structure

Understanding the fee structure of a bank account is crucial. Certain accounts might have monthly fees, while others are free but charge for specific transactions. Look into what types of fees you could incur. Some accounts may charge for cash deposits or ATM usage. Hidden fees can quickly add up. Comparing different banks’ fee structures helps you find an account that fits your budget.

Banking Support

Reliable banking support is essential. Small business owners often need help with account issues or financial advice. The quality of customer service can make a significant difference. Look into whether the bank provides support via phone, chat, or in-person visits. Ensure that knowledgeable representatives are available to assist promptly. Good customer support provides peace of mind, knowing you can resolve issues swiftly.

Consider how these elements affect your business. An account that’s easy to use can save time, while understanding fees ensures you manage costs effectively. Reliable banking support keeps your operations smooth. Address these areas thoughtfully to choose the best bank account for your small business.

Comparing Popular Bank Accounts for Small Businesses

High Street Banks

Choosing a bank can shape your business’s future. High street banks offer robust features like in-person consultations, where financial advisers help you understand your options. Accounts from banks like Barclays, Lloyds, and HSBC provide cheque handling, branch deposits, and dedicated business advisors. Many small firms benefit from features like overdraft facilities, giving a safety net during tight cash flow periods. But, have you considered the charges? Monthly fees and complex fee structures can add up. Evaluating the benefits and costs can help make the decision clearer.

Online-Only Banks

Online-only banks have revolutionised banking for small businesses. Digital-only banks such as Starling Bank and Monzo offer features designed for convenience, from 24/7 mobile banking to instant notifications for transactions. You can manage your finances anytime without visiting a branch. These banks often boast lower fees since they operate without branches. But, what about personalised service? If you need face-to-face advice, online banking might not fulfil that need. Reflect on your comfort with digital interfaces and whether you value 24/7 access over personal interaction before deciding.

Ethical and Co-operative Banks

If business ethics matter to you, then ethical and co-operative banks may align with your values. These banks, like The Co-operative Bank and Triodos, focus on responsible banking, investing in communities, and sustainable projects rather than traditional profit-driven models. You get similar services to high street banks, including personal customer service, but with the assurance your money supports ethical practices. However, service availability might differ. These banks may have fewer branches, which could affect how you access cash and face-to-face services. Balancing ethical considerations with practical needs can guide your banking choice.

All these options show the diverse landscape of business banking in the UK. Does your business need easily accessible branch services, or do you thrive with digital ease? Are ethical practices close to your heart? Consider the full scope of what each bank offers and how it fits your business goals.

Opening Your Small Business Bank Account

Opening a small business bank account involves gathering several key documents. Start with proof of identity which can include a passport or driving licence. You will also need proof of address, such as a utility bill or bank statement. If your business is registered, provide the certificate of incorporation. Sole traders need to show a personal tax return or registration with HMRC. Partnerships must furnish a partnership agreement. Don’t forget business details like VAT registration and business plans. You might need additional documents based on the bank’s requirements, so it’s wise to verify beforehand.

Eligibility Criteria

Banks set certain eligibility criteria for opening a business account. Generally, your business must be registered in the UK. You, as the owner, should be over 18. Most banks need a UK residential address. Your financial standing could affect account approval. Some banks might require a minimum deposit to activate the account. If you’re a non-resident, check if the bank offers non-resident business accounts. Be ready to provide personal and business banking history. Certain types of businesses, including those in high-risk industries, might face stricter criteria. Always consult with your chosen bank to understand their specific requirements.

Managing Your Bank Account Effectively

Tracking income and expenses in real time transforms your financial management. Automated alerts can notify you of large transactions, helping you stay on top of movements. Reviewing monthly statements can uncover patterns and reveal areas where you might cut costs. Linking your bank account with accounting software simplifies this process, giving a clearer view of your financial health. Separate accounts for different business activities can keep things organised. How often do you review your finances? Regular monitoring improves decision-making and allows you to respond swiftly to any cash flow issues.

Saving on Transaction Fees

Reducing transaction fees can boost your bottom line. Some banks offer lower fees for higher monthly balances, so maintaining a minimum balance might be beneficial. Comparing different banking plans helps in selecting one aligned with your transaction volume. For businesses making frequent international payments, checking for competitive foreign exchange rates is crucial. You can often negotiate fees with your bank, especially if you’ve been a loyal customer. Are you aware of your current banking fee structure? Leveraging lower-cost banking channels, like online banking, can further minimise costs.

Regularly review your banking needs and fees to ensure you’re not overpaying. Effective management of your account can make a significant difference in your overall financial efficiency.

Last Thoughts

Choosing the right bank account for your small business is crucial for maintaining financial health and efficiency. By carefully considering factors like transaction limits and online banking features, you can find an account that meets your unique needs.

Remember to keep an eye on your cash flow and look for ways to save on fees. Regularly reviewing your banking arrangements ensures you’re always getting the best deal. With the right account and effective management, your business can thrive financially. Take the time to explore your options and make informed decisions. Your business deserves the best financial foundation possible.